The better known online tax preparation software companies have the marketing muscle to remain better known for a long time. But that is no guarantee of good service, and we decided to take a look at a company that offers a less expensive way to prepare your taxes online. E-File.com doesn’t spend much of what money it has on marketing. Instead it focuses on product development, with the result that it has developed a sound, no-nonsense software product that can guide you through your taxes and even file those taxes with the IRS online.

The company’s products provide complete filing support, and free federal e-filing. E-filing, of course, allows you to receive your tax refund more quickly than does mailing your return in. The company also supports either single or married filing jointly returns.

Featured Products

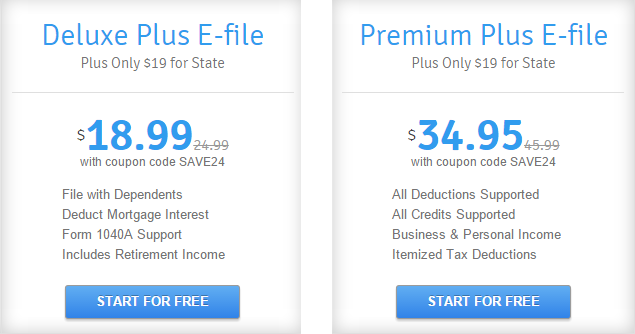

The company’s featured product is its E-File Tax Return software. Their most basic product is the Federal product, and is adequate to support a return for an unmarried individual or a married couple, provided the only income is from W-2 salaries. If you’re married with children and/or a house, the Deluxe Federal product will support a return that includes defendants and mortgage interest deductions. It can also handle retirement income.

And for the more complicated returns, the company offers its Premium Plus product, which supports all deductions and all tax credits, as well as both business and personal income, as well as itemized tax deductions. These products cover all the basics, and include sufficient explanation as you navigate your way through them. And considering how much more difficult tax preparation has become with the increase in federal regulations, including the Affordable Care Act, known also as ObamaCare, these are solid tax preparation products, offered at a substantial discount to the famous brands.

The company also offers an affiliate program, which we suspect is the method it uses to get the word out about its existence, without blowing too much money on marketing. If you manage a blog or corporate website, all you have to do to earn a commission on downloads of their software is to place text or banner ads on your site, with links that include the company’s tracking code. When a visitor to your site clicks the advertisement, and proceeds to purchase tax preparation software, you will get paid. It’s that easy.

The affiliate program is available to affiliates through LinkConnector, a major player in affiliate programs, or through Commission Junction, a smaller player that the company uses, possibly because they are smaller themselves, and have some sympathy for the little guy. If you are already on LinkConnector, the firm’s website will direct you to their affiliate program through a link on their site. The mention that they try to review all applications within 24 hours, to determine if they are willing to be advertised on your site.

And if you are not connected to either of these affiliate-enabling companies, the company provides links that will let you join one of them, and after that you can apply for affiliate status. (With the spread of affiliate programs, website owners are finding an end-around to the major website ad supporting services, and not a moment too soon).

Prices

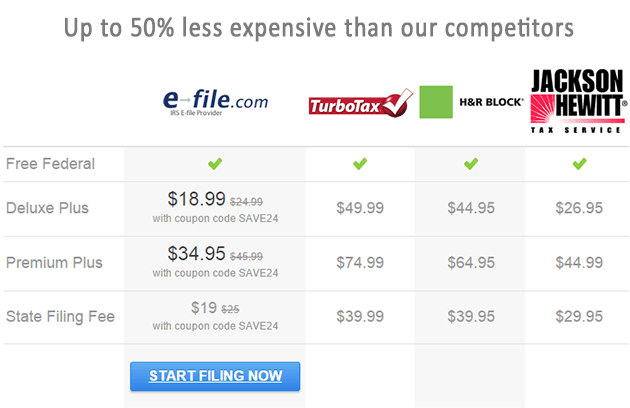

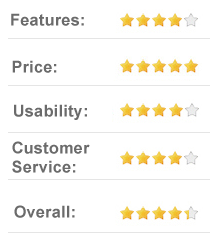

And just how substantial are those discounts? Well, the basic Federal product described above sells for $19.95, and can actually be free if you can obtain certain coupons that are identified on the firm’s website. (The firm is still able to make some money from the state return that you will inevitably also have to order, for $19.95, but that is still a remarkably low overall price).

The Deluxe product for homeowners and child-raisers runs for $24.95, and the Premium Plus product costs $34.95. And you’ll want to add the $19.95 cost of the state return to each of those numbers. The resulting overall cost is still far below what the major tax preparation software firms charge. We are happy to give the company full marks for its dedication to low pricing, something that people need all the more of after they have paid their taxes.

Customer Service

The firm states plainly on its website that, in an effort to provide its customers with an affordable software product, the company limits customer service responses to email. That doesn’t seem like an unreasonable price to pay for being able to pay a far lower price. The firm also cautions that its staff do not provide personalized tax advice, but then neither do the customer service representatives for the major tax preparation firms.

The company, in fact, repeats a few times over its warning that it does not provide tax advice, and does not otherwise serve as “an accountant, CPA, tax agent, advisor, or fiduciary in connection with your tax return.” They also plainly state that the firm does not guarantee the accuracy, integrity, or quality of the information found on its website. OK, we got it. But this kind of warning is probably necessary to avoid the sort of lawsuits that, if successful, would put the firm right out of business.

The website does helpfully provide a list of the information and documents that taxpayers will need to have handy to enable them to successfully complete their returns. The firm lists W-2s, form 1099s for independent business owners, as well as investment records, mortgage payment documents, and all other potentially relevant information.

Criticism

Well, there has been some criticism from taxpayers who wanted more detailed navigation and guidance as they completed their returns. At the same time, there seem to be at least an equal number of users who expressed gratitude for the low price, and who found the service adequate.

There was also a good deal of comment by customers who had been unaware that this smaller player was active in the tax preparation space, and offering no-nonsense software for both federal and state returns at, essentially, half of the price that the big boys charged. Those customers were quite appreciative. After all, it takes quite an investment of time, money and energy to produce a comprehensive tax preparation software not just for federal returns, but also for each of the fifty states. Doing so at such low price points is a real achievement, and the taxpayers whose comments we surveyed certainly thought so themselves.

Final Thoughts

As is well known, this past year one of the more famous tax preparation companies limited the ability of one of its more basic products to handle business returns, and failed to notify its customers of the change. The result was a huge embarrassment for the company.

We will say that with its forthright acknowledgement of the abilities, and limitations, of its services, E-File is unlikely to find itself in the same position. You know just what you get, and if your financial life is on the more simple and basic side (even if you are a homeowner who runs a business) the company’s products will likely be more than sufficient to support your tax filing needs.

Even if you have to wait until next year to enjoy the benefits of their service, it may well be worth your while to make a note of the name, and return next year when you employer has sent out your W-2, and you’re ready to enjoy those blissful few hours of tax preparation that we all find ourselves enduring. At least now you won’t suffer an additional bite from the tax preparation software, and that is thanks to E-File.